Comprehensive Guide to Creating a Sample Family Loan Agreement Template for Smooth Transactions

#### Sample Family Loan Agreement TemplateWhen it comes to lending money to family members, having a clear and concise agreement is crucial. A **sample fami……

#### Sample Family Loan Agreement Template

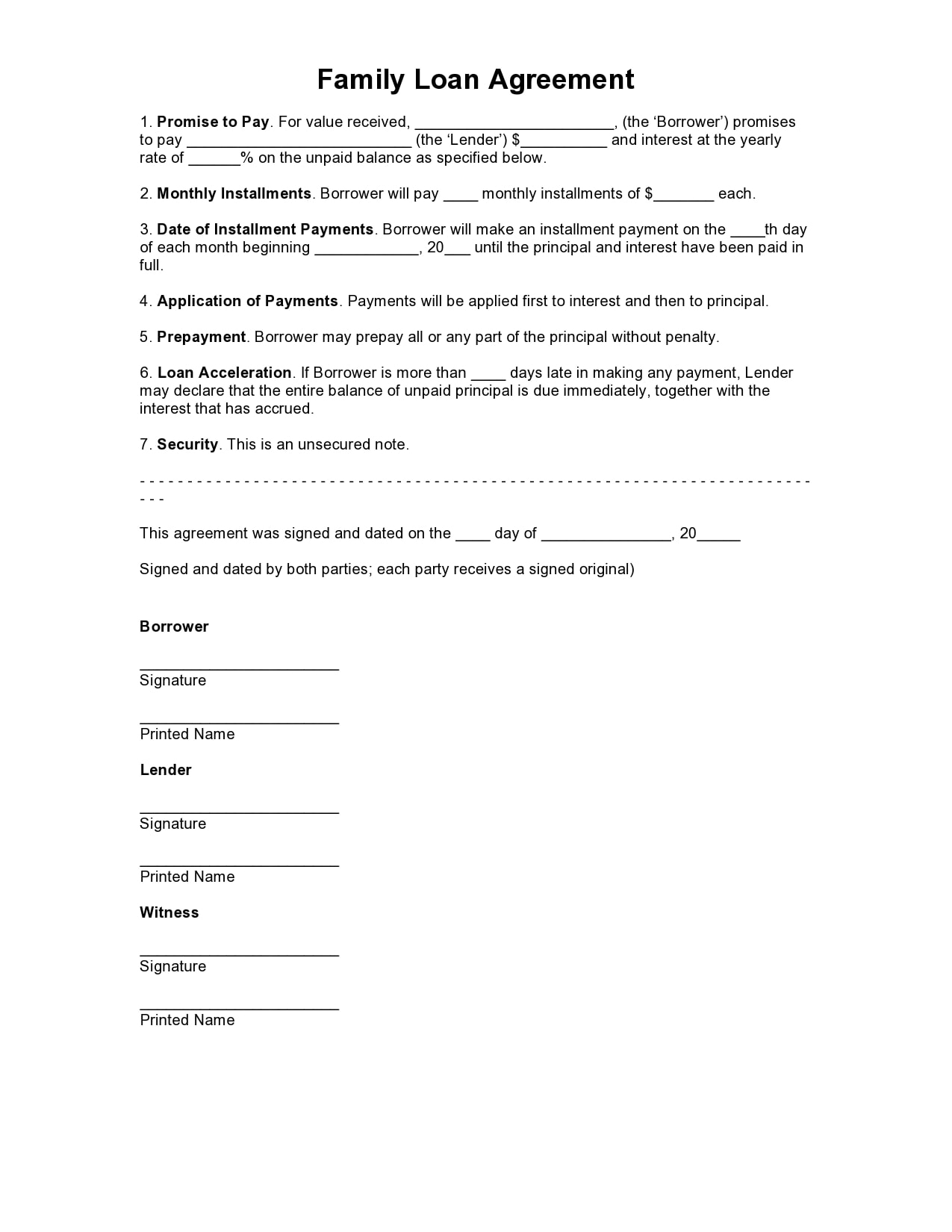

When it comes to lending money to family members, having a clear and concise agreement is crucial. A **sample family loan agreement template** serves as an essential tool to ensure that both parties understand the terms and conditions of the loan. This template outlines the responsibilities and expectations of both the lender and the borrower, helping to prevent misunderstandings and potential conflicts.

#### Importance of a Family Loan Agreement

Using a **sample family loan agreement template** can significantly reduce the risks associated with informal lending. While lending to family can be a noble gesture, it can also strain relationships if expectations are not clearly defined. A well-drafted agreement provides a written record of the loan details, including the amount borrowed, interest rates, repayment schedule, and any other pertinent conditions.

#### Key Components of a Family Loan Agreement

A **sample family loan agreement template** typically includes several key components:

1. **Parties Involved**: Clearly state the names and contact information of both the lender and the borrower.

2. **Loan Amount**: Specify the total amount of money being loaned.

3. **Interest Rate**: If applicable, include the interest rate and whether it is fixed or variable.

4. **Repayment Terms**: Outline the repayment schedule, including due dates and payment methods.

5. **Default Clause**: Describe the consequences if the borrower fails to repay the loan as agreed.

6. **Governing Law**: Indicate the jurisdiction that will govern the agreement in case of disputes.

7. **Signatures**: Both parties should sign and date the agreement to make it legally binding.

#### Benefits of Using a Template

Utilizing a **sample family loan agreement template** has numerous advantages:

- **Time-Saving**: A template provides a ready-made structure that can be easily customized to fit your specific needs.

- **Clarity**: It helps clarify the terms of the loan for both parties, reducing the likelihood of misunderstandings.

- **Professionalism**: Having a formal document conveys seriousness and professionalism, which can enhance trust between family members.

- **Legal Protection**: A written agreement can provide legal protection for both parties in case of disputes.

#### How to Customize Your Template

When using a **sample family loan agreement template**, it’s essential to customize it to reflect your unique situation. Here are some tips:

- **Adjust Terms**: Modify the interest rate and repayment schedule based on what is mutually agreed upon.

- **Include Additional Clauses**: If necessary, add clauses that address specific concerns, such as collateral or early repayment options.

- **Review with a Legal Professional**: Consider having a lawyer review the agreement to ensure that it complies with local laws and regulations.

#### Conclusion

In conclusion, a **sample family loan agreement template** is a valuable resource for anyone considering lending money to a family member. It helps establish clear expectations and protects both parties involved. By taking the time to create a well-structured agreement, you can foster trust and maintain healthy family relationships while navigating the complexities of financial transactions. Remember, communication is key, and having a written agreement is a proactive step towards ensuring a smooth lending experience.