Understanding Student Loan Unsubsidized: A Comprehensive Guide to Navigating Your Higher Education Financing Options

Guide or Summary:Student Loan Unsubsidized refers to a type of federal student loan where the government does not pay the interest while the borrower is in……

Guide or Summary:

#### What is Student Loan Unsubsidized?

Student Loan Unsubsidized refers to a type of federal student loan where the government does not pay the interest while the borrower is in school or during deferment periods. Unlike subsidized loans, which are designed to assist students with financial need, unsubsidized loans are available to a broader range of borrowers, regardless of their financial situation.

#### Why Choose Student Loan Unsubsidized?

One of the primary advantages of student loan unsubsidized loans is that they are accessible to a wider audience. Students who apply for federal aid may find that they qualify for these loans even if they do not demonstrate significant financial need. This flexibility can be crucial for students who are pursuing higher education but may not meet the strict criteria for subsidized loans.

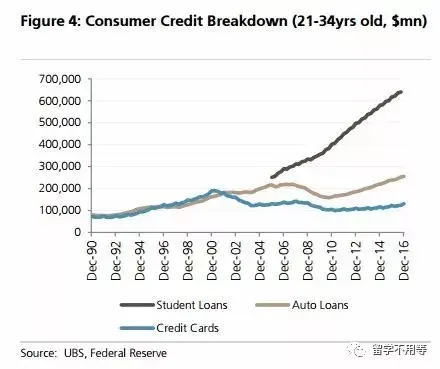

#### Interest Accumulation on Student Loan Unsubsidized

While student loan unsubsidized loans can help students cover their educational expenses, it’s essential to understand how interest works with these loans. Interest begins accruing from the moment the loan is disbursed, which means that students can end up with a larger debt load by the time they graduate. For example, if a student takes out an unsubsidized loan of $10,000 with a 5% interest rate, they will owe more than $10,000 by the time they start repaying it after graduation.

#### Repayment Options for Student Loan Unsubsidized

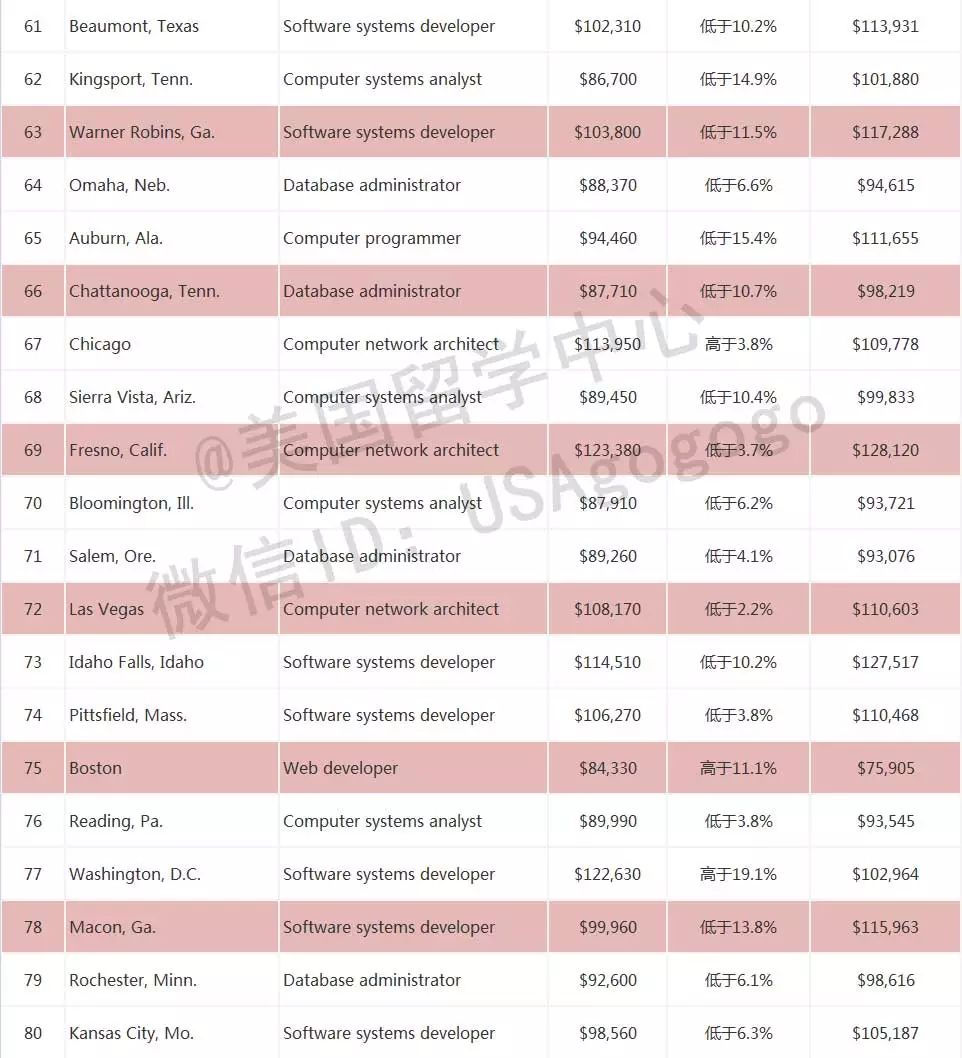

Students with student loan unsubsidized loans have various repayment options available to them. The standard repayment plan typically spans ten years, but borrowers can also explore income-driven repayment plans, which adjust monthly payments based on income and family size. This flexibility can make it easier for graduates to manage their loan payments while they establish their careers.

#### Tips for Managing Student Loan Unsubsidized Debt

1. **Understand Your Loan Terms**: Before accepting a student loan unsubsidized, make sure you fully understand the terms, interest rates, and repayment options. This knowledge will empower you to make informed financial decisions.

2. **Consider Making Interest Payments While in School**: If possible, try to make interest payments on your unsubsidized loans while you’re still in school. This can prevent your loan balance from increasing significantly once you graduate.

3. **Create a Budget**: After graduation, create a budget that includes your loan payments. This will help you track your expenses and ensure that you can make your payments on time.

4. **Explore Forgiveness Programs**: Some professions may qualify for loan forgiveness programs. Research whether your career path offers any such opportunities that could alleviate your debt burden.

5. **Stay Informed**: Keep yourself updated on any changes to federal student loan policies, as these can affect your repayment options and overall strategy for managing your debt.

#### Conclusion

In conclusion, student loan unsubsidized loans can be a valuable resource for students pursuing higher education. While they provide essential funding, it’s crucial to understand the implications of interest accrual and repayment options. By staying informed and proactive about managing your loans, you can navigate your educational financing effectively and work toward a debt-free future.