Maximizing Your Tax Deduction for Student Loan Payments: A Comprehensive Guide

---**Tax Deduction for Student Loan Payments** (学生贷款还款的税收扣除)In recent years, the burden of student loan debt has become a significant concern for many gradu……

---

**Tax Deduction for Student Loan Payments** (学生贷款还款的税收扣除)

In recent years, the burden of student loan debt has become a significant concern for many graduates. With the rising costs of education, understanding the financial implications of student loans is crucial. One of the most beneficial aspects available to borrowers is the **tax deduction for student loan payments**. This deduction can provide much-needed relief during tax season, allowing borrowers to reduce their taxable income based on the amount they have paid towards their student loans.

#### What is the Tax Deduction for Student Loan Payments?

The **tax deduction for student loan payments** allows qualifying individuals to deduct up to $2,500 of interest paid on their student loans from their taxable income. This means that if you have paid $2,500 or more in interest on your qualified student loans during the tax year, you can lower your taxable income by that amount, potentially resulting in a lower tax bill or a larger tax refund.

#### Who Qualifies for the Deduction?

To qualify for the **tax deduction for student loan payments**, you must meet certain criteria:

1. **Filing Status**: You must file your taxes as a single, head of household, or married filing jointly. If you are married filing separately, you cannot claim this deduction.

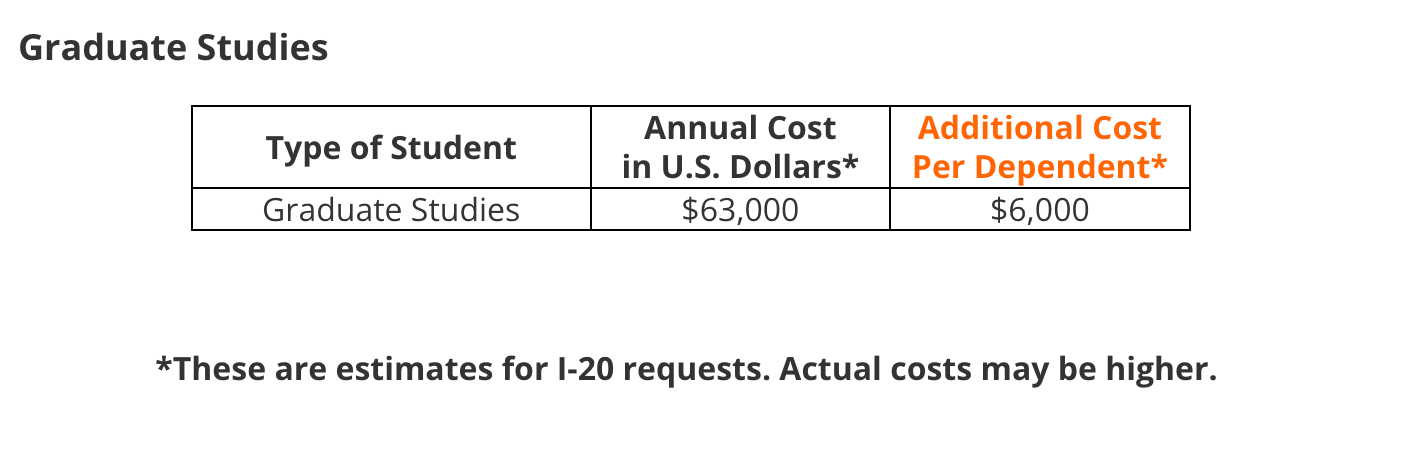

2. **Income Limits**: The deduction begins to phase out for individuals with a modified adjusted gross income (MAGI) above $70,000 ($140,000 for married couples filing jointly). If your income exceeds $85,000 (or $170,000 for married couples), you cannot claim the deduction.

3. **Loan Requirements**: The loans must be taken out solely to pay for qualified higher education expenses for you, your spouse, or your dependents. Additionally, the loans must be in your name and not in default.

#### How to Claim the Deduction

To claim the **tax deduction for student loan payments**, follow these steps:

1. **Gather Documentation**: Collect your Form 1098-E, which your loan servicer should provide if you paid $600 or more in interest during the year. This form will detail the amount of interest you paid.

2. **Complete Your Tax Return**: When filling out your tax return, report the amount of interest paid on the appropriate lines. For most taxpayers, this will be on Form 1040, Schedule 1.

3. **Consider Additional Deductions**: In addition to the **tax deduction for student loan payments**, you may also qualify for other tax benefits related to education, such as the American Opportunity Credit or the Lifetime Learning Credit. Be sure to explore all available options to maximize your tax savings.

#### Benefits of the Deduction

The **tax deduction for student loan payments** can significantly ease the financial burden of student loans. By reducing your taxable income, you may fall into a lower tax bracket, resulting in a lower overall tax liability. This deduction can also be particularly beneficial for recent graduates who may be struggling to make ends meet while paying off their loans.

#### Conclusion

Understanding and utilizing the **tax deduction for student loan payments** can lead to substantial financial benefits for borrowers. By ensuring you meet the eligibility requirements and accurately reporting your interest payments, you can take advantage of this deduction and reduce your tax burden. As student loan debt continues to be a pressing issue, staying informed about available tax benefits is essential for managing your finances effectively.