"Unlock Savings: How to Refinance Car Loan Massachusetts for Better Rates and Terms"

Guide or Summary:Understanding the Benefits of RefinancingWhen to Consider RefinancingSteps to Refinance Your Car Loan in MassachusettsPotential Drawbacks o……

Guide or Summary:

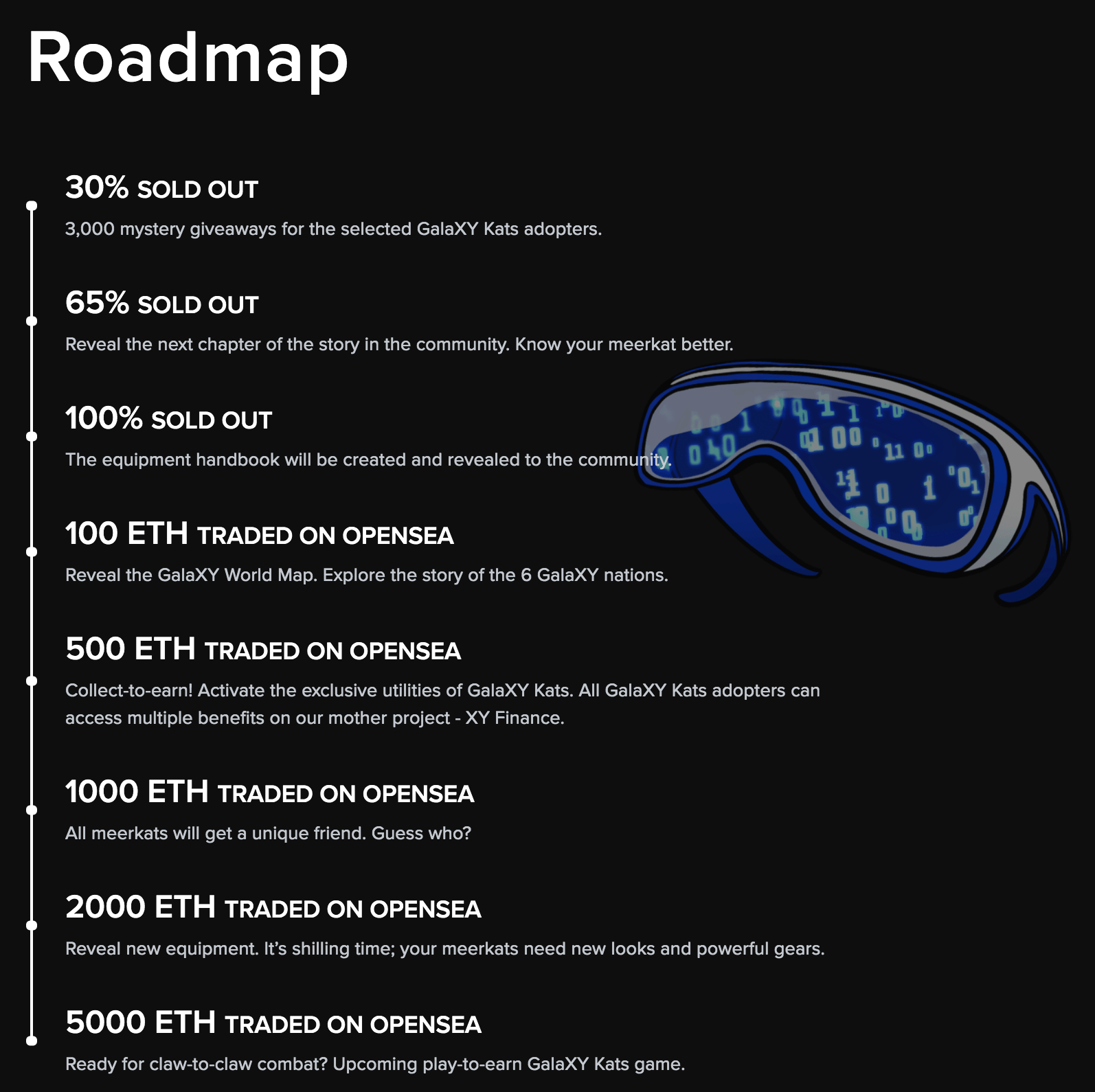

- Understanding the Benefits of Refinancing

- When to Consider Refinancing

- Steps to Refinance Your Car Loan in Massachusetts

- Potential Drawbacks of Refinancing

**Refinance Car Loan Massachusetts** (再融资汽车贷款 马萨诸塞州)

In the ever-changing landscape of auto financing, many car owners in Massachusetts are looking for ways to save money and reduce their monthly payments. One of the most effective strategies is to **refinance car loan Massachusetts**. This process involves taking out a new loan to pay off your existing car loan, often at a lower interest rate or with better terms.

Understanding the Benefits of Refinancing

Refinancing your car loan can offer several benefits. First and foremost, it can lead to lower monthly payments. If interest rates have dropped since you took out your original loan, or if your credit score has improved, you may qualify for a better rate, thus reducing your overall payment burden. Additionally, refinancing can help you shorten the loan term, allowing you to pay off your vehicle faster and save on interest payments over the life of the loan.

When to Consider Refinancing

It's important to know when refinancing makes sense. If you find that your current interest rate is significantly higher than the current market rates, or if you've improved your credit score since you first financed your vehicle, it may be time to consider refinancing. Additionally, if you are struggling with your current monthly payments, refinancing can provide some relief by extending the loan term, albeit at the cost of paying more interest over time.

Steps to Refinance Your Car Loan in Massachusetts

1. **Check Your Credit Score**: Before you begin the refinancing process, check your credit score. This will give you an idea of what interest rates you might qualify for.

2. **Research Lenders**: Look for lenders that offer competitive rates for refinancing car loans. Consider both traditional banks and credit unions, as well as online lenders.

3. **Gather Documentation**: You'll typically need to provide documentation such as your current loan details, proof of income, and identification.

4. **Apply for Refinancing**: Once you've found a lender that meets your needs, submit your application. Be prepared for a hard credit inquiry, which may temporarily affect your credit score.

5. **Review the New Loan Terms**: If approved, carefully review the terms of the new loan. Ensure that it meets your financial goals and that you understand any fees associated with refinancing.

6. **Finalize the Process**: Once you're satisfied with the new loan terms, finalize the process with your new lender. They will pay off your existing loan, and you'll start making payments on the new loan.

Potential Drawbacks of Refinancing

While refinancing can be beneficial, it's not without its drawbacks. For instance, extending the loan term can lead to paying more in interest over time. Additionally, some lenders may charge fees for refinancing, which could offset any savings you gain from a lower interest rate. It's crucial to do the math and ensure that refinancing is the right financial decision for your situation.

In summary, **refinance car loan Massachusetts** can be a smart financial move for many car owners. By understanding the benefits and potential drawbacks, and following the steps outlined above, you can make an informed decision that could save you money and improve your financial situation. Whether you're looking to lower your monthly payments, reduce your interest rate, or pay off your car faster, refinancing could be the solution you need.