A Comprehensive Guide on How to Get Verified for an Auto Loan: Essential Steps and Tips

Guide or Summary:Understanding Auto LoansImportance of Getting VerifiedSteps to Get Verified for an Auto LoanTips for a Smooth Verification Process**Transla……

Guide or Summary:

- Understanding Auto Loans

- Importance of Getting Verified

- Steps to Get Verified for an Auto Loan

- Tips for a Smooth Verification Process

**Translation of "how to get verified for auto loan":** how to get verified for auto loan

---

Understanding Auto Loans

Before diving into the process of how to get verified for an auto loan, it’s essential to understand what an auto loan is. An auto loan is a type of financing specifically designed to help you purchase a vehicle. Lenders provide you with the funds needed to buy a car, and you repay this amount over time, typically with interest. Understanding the basics of auto loans can help you navigate the verification process more effectively.

Importance of Getting Verified

Getting verified for an auto loan is a crucial step in the car-buying process. Verification involves confirming your identity, income, creditworthiness, and other relevant factors that lenders consider before approving your loan. This step is vital as it helps lenders assess the risk of lending you money and determines the loan amount and interest rate you may qualify for. Knowing how to get verified for an auto loan can save you time and increase your chances of approval.

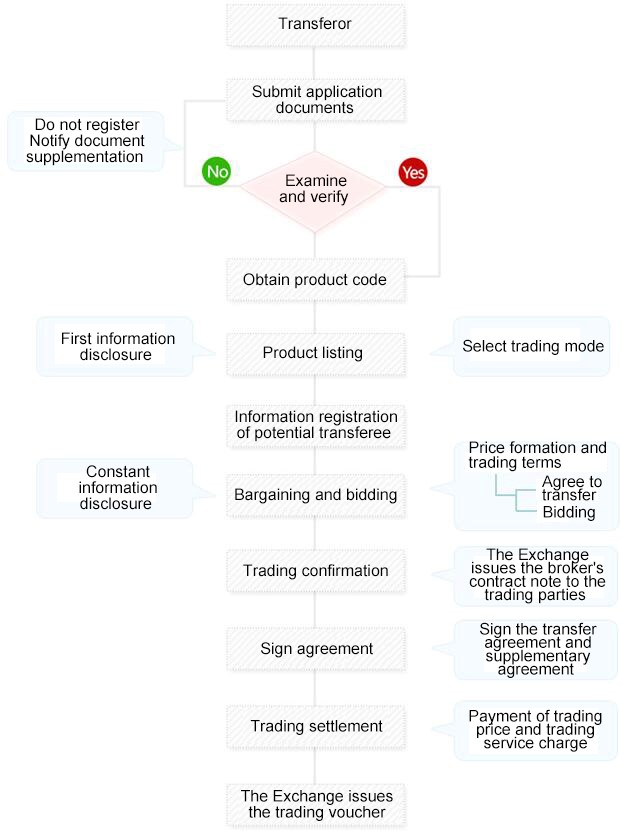

Steps to Get Verified for an Auto Loan

1. **Check Your Credit Score**: Before applying for an auto loan, check your credit score. Lenders use your credit score to evaluate your creditworthiness. A higher score can lead to better loan terms. If your score is low, consider taking steps to improve it before applying.

2. **Gather Necessary Documents**: To get verified for an auto loan, you’ll need to provide specific documents. Commonly required documents include proof of income (like pay stubs or tax returns), proof of residency (like utility bills), and identification (such as a driver’s license or passport).

3. **Pre-Approval Process**: Many lenders offer a pre-approval process, which allows you to see how much you can borrow before you start shopping for a car. This process often involves the lender reviewing your credit history and other financial information to give you a preliminary loan amount.

4. **Choose the Right Lender**: Research various lenders to find the best rates and terms. Consider credit unions, banks, and online lenders. Each may have different requirements for verification, so it’s essential to understand what each lender needs.

5. **Submit Your Application**: Once you’ve chosen a lender, complete the application process. This may involve filling out an online form or visiting a branch. Be prepared to provide all necessary documentation for verification.

6. **Wait for Approval**: After submitting your application, the lender will review your information and conduct a verification process. This may take anywhere from a few minutes to a few days, depending on the lender.

7. **Review Loan Terms**: If approved, carefully review the loan terms offered by the lender. Pay attention to the interest rate, repayment period, and any fees associated with the loan. Make sure you understand all aspects of the loan before signing.

Tips for a Smooth Verification Process

- **Be Honest**: Provide accurate information on your application. Misrepresenting your financial situation can lead to denial or future issues with your loan.

- **Stay Organized**: Keep all your documents organized and readily accessible. This can speed up the verification process significantly.

- **Ask Questions**: If you’re unsure about any part of the process, don’t hesitate to ask the lender for clarification. Understanding the process can help you feel more confident.

Knowing how to get verified for an auto loan is essential for anyone looking to purchase a vehicle. By understanding the steps involved, gathering the necessary documents, and choosing the right lender, you can streamline the verification process and increase your chances of securing favorable loan terms. Remember, preparation is key, and being informed will empower you to make the best financial decision for your auto purchase.