Understanding Home Equity Loan Rates in Michigan: Your Comprehensive Guide to Financing Options

#### Home Equity Loan Rates MichiganHome equity loans are a popular financing option for homeowners looking to leverage the value of their property. In Mich……

#### Home Equity Loan Rates Michigan

Home equity loans are a popular financing option for homeowners looking to leverage the value of their property. In Michigan, understanding the intricacies of home equity loan rates is crucial for making informed financial decisions. As property values fluctuate and interest rates change, it’s essential to stay updated on the latest trends to secure the best possible deal.

#### What is a Home Equity Loan?

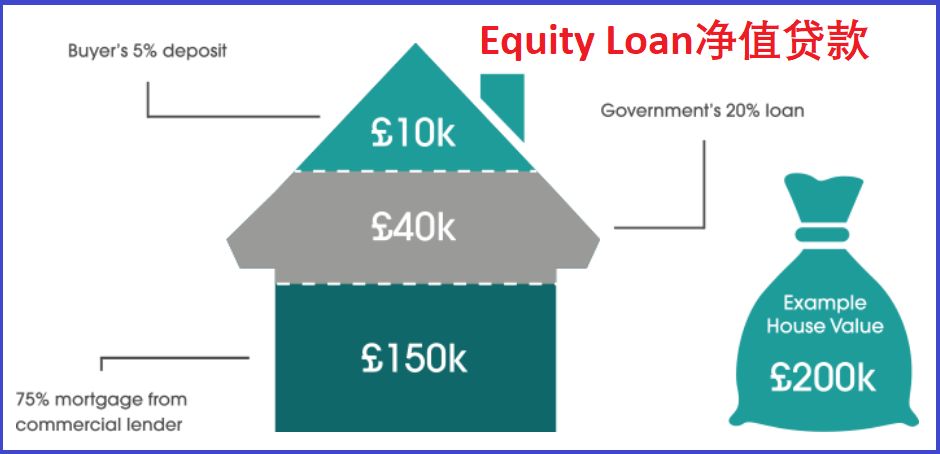

A home equity loan allows homeowners to borrow against the equity they have built up in their property. Equity is calculated as the difference between the current market value of the home and the remaining balance on the mortgage. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity. Lenders typically allow you to borrow a percentage of this equity, often up to 85%.

#### Factors Influencing Home Equity Loan Rates in Michigan

Several factors can influence the home equity loan rates you may encounter in Michigan:

1. **Credit Score**: Lenders use credit scores to assess the risk of lending. A higher credit score generally leads to lower interest rates.

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the loan amount to the appraised value of the home. A lower LTV can result in better rates.

3. **Market Conditions**: Economic factors, including inflation and the Federal Reserve’s interest rate policies, can impact home equity loan rates.

4. **Type of Loan**: Fixed-rate loans typically have different rates compared to adjustable-rate loans. Fixed rates provide stability, while adjustable rates may start lower but can fluctuate.

5. **Lender Policies**: Different lenders have varying criteria and rates, so it’s essential to shop around for the best deal.

#### Current Trends in Home Equity Loan Rates in Michigan

As of late 2023, home equity loan rates in Michigan have shown some variability due to economic conditions. Following a period of rising interest rates, many homeowners are exploring their options for tapping into home equity. It’s important to monitor these trends, as rates can change frequently based on market dynamics.

#### How to Secure the Best Home Equity Loan Rates in Michigan

To ensure you get the best home equity loan rates in Michigan, consider the following steps:

1. **Improve Your Credit Score**: Before applying, check your credit report and take steps to improve your score if necessary.

2. **Compare Lenders**: Don’t settle for the first offer you receive. Compare rates from multiple lenders to find the best deal.

3. **Consider Your Loan Amount**: Borrowing less than your maximum equity can improve your LTV ratio, potentially lowering your rate.

4. **Negotiate Terms**: Don’t hesitate to negotiate with lenders. They may be willing to offer better terms to secure your business.

5. **Stay Informed**: Keep an eye on market trends and economic news that could affect interest rates.

#### Conclusion

Understanding home equity loan rates in Michigan is essential for homeowners looking to make the most of their property’s value. By considering factors such as credit score, loan-to-value ratio, and current market conditions, you can position yourself to secure favorable financing. Always remember to compare offers from different lenders and stay informed about economic trends that could impact your loan rates. With careful planning and research, tapping into your home equity can be a smart financial move.