"Maximize Your Savings with the Bankrate Calculator Loan: A Comprehensive Guide to Smart Borrowing"

Guide or Summary:Understanding the Bankrate Calculator LoanWhy Use the Bankrate Calculator Loan?How to Use the Bankrate Calculator LoanComparing Loan Offers……

Guide or Summary:

- Understanding the Bankrate Calculator Loan

- Why Use the Bankrate Calculator Loan?

- How to Use the Bankrate Calculator Loan

- Comparing Loan Offers with the Bankrate Calculator Loan

- Tips for Getting the Most Out of the Bankrate Calculator Loan

---

### Description:

Understanding the Bankrate Calculator Loan

The Bankrate Calculator Loan is an essential tool for anyone considering taking out a loan. Whether you’re looking to finance a home, buy a car, or consolidate debt, understanding how to use this calculator can help you make informed financial decisions. The Bankrate Calculator allows users to input various loan parameters, such as loan amount, interest rate, and loan term, to estimate monthly payments and total interest paid over the life of the loan.

Why Use the Bankrate Calculator Loan?

Using the Bankrate Calculator Loan provides several advantages. First, it gives you a clear picture of what your monthly payments will look like, helping you budget effectively. Second, it allows you to compare different loan offers and terms, ensuring you choose the best option for your financial situation. Lastly, it can help you understand the long-term costs associated with borrowing, which is crucial for making sound financial decisions.

How to Use the Bankrate Calculator Loan

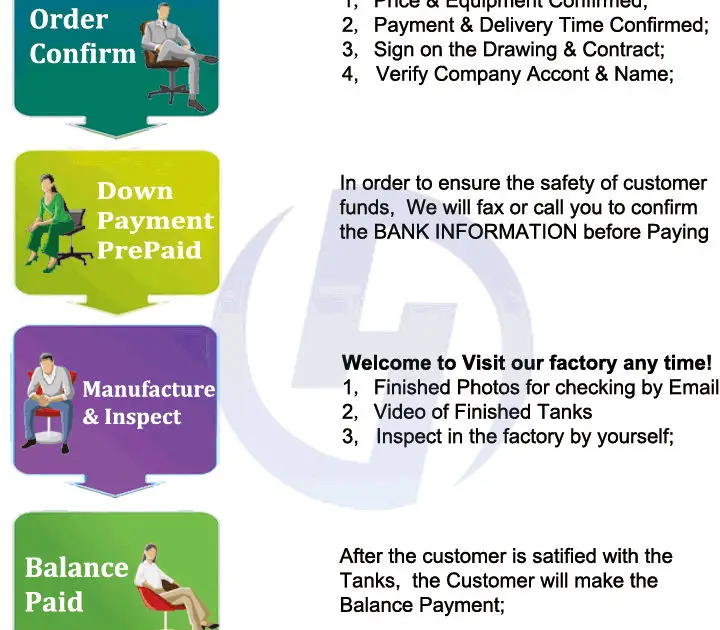

To get started with the Bankrate Calculator Loan, visit the Bankrate website and navigate to the loan calculator section. Here, you will be prompted to enter specific details about the loan you are considering. Key inputs include:

1. **Loan Amount**: The total amount you plan to borrow.

2. **Interest Rate**: The annual percentage rate (APR) offered by the lender.

3. **Loan Term**: The duration over which you will repay the loan, typically measured in years.

Once you enter these details, the calculator will generate an estimate of your monthly payments, total interest paid, and the total cost of the loan. This information is invaluable for budgeting and financial planning.

Comparing Loan Offers with the Bankrate Calculator Loan

One of the most significant benefits of the Bankrate Calculator Loan is its ability to facilitate comparisons between different loan offers. By adjusting the interest rate and loan term in the calculator, you can see how these changes affect your monthly payment and total interest. This feature is particularly useful when shopping around for loans, as it allows you to quickly identify the most cost-effective options.

Tips for Getting the Most Out of the Bankrate Calculator Loan

To maximize your experience with the Bankrate Calculator Loan, consider the following tips:

- **Shop Around**: Always compare multiple lenders and their offers. Use the calculator to evaluate how different interest rates and terms affect your overall loan costs.

- **Consider Additional Costs**: Remember to factor in other costs associated with borrowing, such as origination fees, insurance, and closing costs, which can impact your total loan expenses.

- **Check Your Credit Score**: Before applying for a loan, check your credit score. A higher credit score can often lead to better interest rates, significantly reducing your overall borrowing costs.

The Bankrate Calculator Loan is an invaluable resource for anyone looking to borrow money wisely. By understanding how to use this tool effectively, you can make informed decisions that align with your financial goals. Whether you’re planning to buy a home, finance a vehicle, or consolidate debts, the Bankrate Calculator can help you navigate the complexities of borrowing and ensure you secure the best possible loan terms. Start using it today to take control of your financial future!