Maximizing Your Credit Home Loan Score: A Comprehensive Guide to Securing the Best Mortgage Rates

Guide or Summary:CreditHome LoanScore: The Key to Securing the Best Mortgage RatesCredit Home Loan Score: Understanding Its ImportanceImproving Your Credit……

Guide or Summary:

- CreditHome LoanScore: The Key to Securing the Best Mortgage Rates

- Credit Home Loan Score: Understanding Its Importance

- Improving Your Credit Home Loan Score: Strategies for Success

- Preparing for a Home Loan Application: Tips for Success

CreditHome LoanScore: The Key to Securing the Best Mortgage Rates

When it comes to securing a home loan, your credit score plays a pivotal role in determining the interest rates you'll be offered. A higher credit score can mean a lower interest rate, which can save you thousands of dollars over the life of your mortgage. In this comprehensive guide, we'll delve into the intricacies of maximizing your credit home loan score to help you secure the best mortgage rates possible.

Credit Home Loan Score: Understanding Its Importance

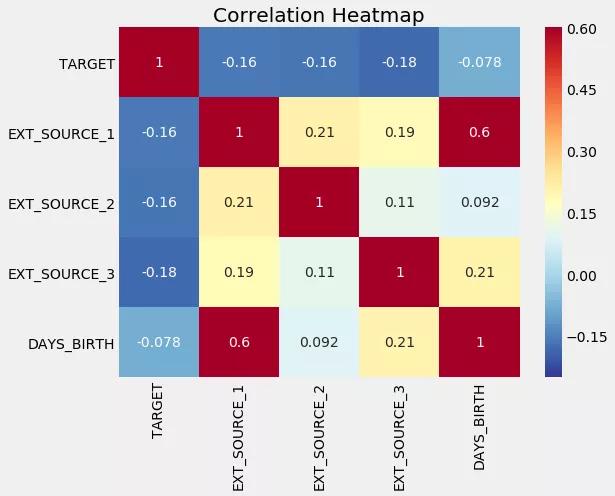

Your credit home loan score is a numerical representation of your creditworthiness. It's a snapshot of your financial health, taking into account your payment history, credit utilization, length of credit history, types of credit, and new credit. Lenders use this score to assess the risk associated with lending you money. A higher score indicates a lower risk, making you a more attractive borrower.

Improving Your Credit Home Loan Score: Strategies for Success

Improving your credit home loan score is a gradual process that requires patience and discipline. Here are some effective strategies to help you boost your score:

1. **Pay Your Bills on Time**: Payment history is one of the most significant factors affecting your credit score. Late payments can have a detrimental impact on your score, so it's crucial to pay your bills on time, every time.

2. **Keep Your Credit Utilization Low**: Credit utilization refers to the amount of credit you're using compared to your total credit limit. Aim to keep your utilization below 30% to demonstrate responsible credit usage.

3. **Maintain a Long Credit History**: The length of your credit history is another crucial factor. The longer your credit history, the better. If you're new to credit, consider opening a secured credit card or becoming an authorized user on someone else's credit card to start building your credit.

4. **Diversify Your Credit Mix**: Having a mix of credit types, such as credit cards, auto loans, and mortgages, can positively impact your credit score. However, be cautious not to take on too much debt.

5. **Check Your Credit Report Regularly**: Errors on your credit report can negatively affect your credit score. Regularly checking your credit report can help you identify and correct any inaccuracies.

Preparing for a Home Loan Application: Tips for Success

Once you've improved your credit home loan score, it's time to prepare for your home loan application. Here are some tips to help you navigate the process:

1. **Save for a Down Payment**: Larger down payments can reduce your loan-to-value ratio, making you a more attractive borrower.

2. **Get Pre-Approved for a Mortgage**: Pre-approval can demonstrate your financial readiness and show sellers you're serious about buying a home.

3. **Shop Around for the Best Rates**: Don't settle for the first mortgage offer you receive. Shop around to compare rates and terms from different lenders.

4. **Understand Your Loan Options**: Fixed-rate mortgages and adjustable-rate mortgages (ARMs) have different characteristics. Choose the option that best fits your financial situation and risk tolerance.

In conclusion, maximizing your credit home loan score is essential for securing the best mortgage rates. By understanding the importance of your credit score and implementing effective strategies to improve it, you can increase your chances of getting approved for a home loan at favorable terms. Remember, a little effort in improving your credit score can lead to significant savings over the life of your mortgage. Start today and take the first step towards homeownership.