Unlock Your Dream Home: How to Pre Qualify VA Loan for Veterans and Active Duty Service Members

#### Description:Navigating the world of home financing can be overwhelming, especially for veterans and active-duty service members who have served our cou……

#### Description:

Navigating the world of home financing can be overwhelming, especially for veterans and active-duty service members who have served our country. One of the most advantageous options available is the VA loan, which offers unique benefits such as no down payment and competitive interest rates. However, before you dive into the process of securing a VA loan, it’s essential to understand how to effectively pre qualify VA loan. This step can streamline your home buying journey and position you as a serious buyer in the competitive real estate market.

**What is a VA Loan?**

A VA loan is a mortgage option provided by private lenders and backed by the U.S. Department of Veterans Affairs. It is specifically designed to assist veterans, active-duty service members, and certain members of the National Guard and Reserves in purchasing homes. The most significant advantage of a VA loan is the ability to buy a home without a down payment, which can be a substantial barrier for many homebuyers. Additionally, VA loans typically come with lower interest rates and do not require private mortgage insurance (PMI), making them a cost-effective choice.

**Why Pre-Qualifying is Important**

Pre-qualifying for a VA loan is a crucial first step in the home buying process. It involves a preliminary assessment of your financial situation by a lender, which helps you understand how much you can afford to borrow. This assessment typically includes a review of your credit score, income, debts, and overall financial health. By getting pre-qualified, you gain several advantages:

1. **Identifying Your Budget**: Pre-qualification gives you a clear idea of your price range, allowing you to focus on homes that fit your financial capabilities. This prevents you from wasting time on properties that are out of reach.

2. **Strengthening Your Offer**: In a competitive housing market, having a pre-qualification letter can make your offer more appealing to sellers. It shows that you are a serious buyer who has taken the necessary steps to secure financing.

3. **Streamlining the Process**: Pre-qualification can expedite the loan process once you find a home. Since the lender has already assessed your financial situation, you’ll have a head start on the required documentation and approval process.

**How to Pre Qualify for a VA Loan**

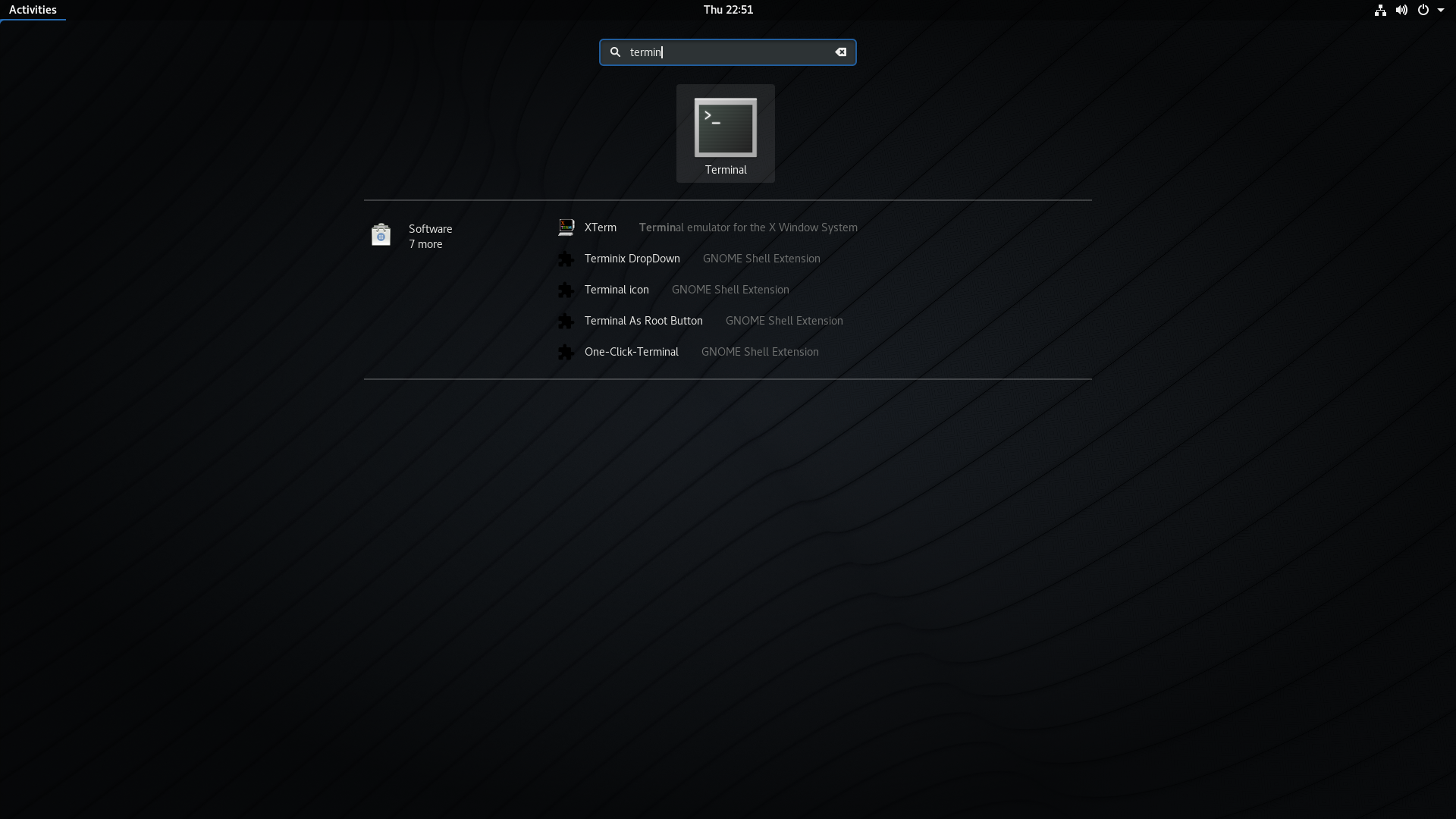

The pre-qualification process for a VA loan is relatively straightforward. Here are the steps you need to follow:

1. **Gather Financial Documents**: Before approaching a lender, collect essential documents such as your W-2 forms, pay stubs, bank statements, and any other relevant financial information. This will help the lender assess your financial situation more accurately.

2. **Check Your Credit Score**: While VA loans have flexible credit requirements, it’s still beneficial to know your credit score before applying. If your score is lower than expected, you may want to take steps to improve it before seeking pre-qualification.

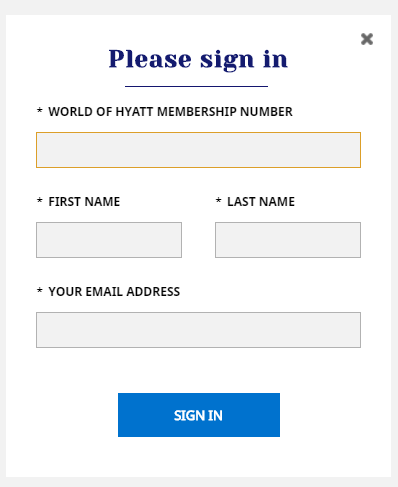

3. **Choose a Lender**: Research different lenders who offer VA loans. Look for lenders with experience in handling VA loans and positive reviews from other veterans. You can also seek recommendations from fellow service members.

4. **Submit Your Application**: Once you’ve selected a lender, fill out the pre-qualification application. This will typically involve providing your financial information and answering questions about your employment and debts.

5. **Receive Your Pre-Qualification Letter**: If approved, the lender will issue a pre-qualification letter outlining the loan amount you are eligible for. This letter is a crucial document when making offers on homes.

**Final Thoughts**

Pre qualifying for a VA loan is an essential step for veterans and active-duty service members looking to purchase a home. By understanding the benefits of VA loans and the pre-qualification process, you can position yourself for success in the housing market. Remember that each lender may have different requirements, so it’s important to shop around and find the best fit for your financial needs. With the right preparation and knowledge, you can unlock the door to your dream home with a VA loan.