FHA Loan Salary Requirements: What You Need to Know to Qualify for Your Dream Home

#### Description:When it comes to purchasing a home, understanding the FHA Loan Salary Requirements is crucial for prospective buyers. The Federal Housing A……

#### Description:

When it comes to purchasing a home, understanding the FHA Loan Salary Requirements is crucial for prospective buyers. The Federal Housing Administration (FHA) offers loans that are designed to help individuals with lower to moderate incomes achieve homeownership. However, to qualify for an FHA loan, there are specific salary and income requirements that applicants must meet. In this guide, we will delve into the intricacies of these requirements, helping you navigate the process and make informed decisions.

The FHA loan program is particularly appealing for first-time homebuyers due to its lower down payment options and flexible credit score requirements. However, the FHA Loan Salary Requirements are an essential aspect of the qualification process. Generally, lenders will look at your gross monthly income to determine how much you can afford to borrow. This includes all sources of income, such as wages, bonuses, and any additional earnings.

One of the primary stipulations of the FHA Loan Salary Requirements is the debt-to-income (DTI) ratio. This ratio compares your total monthly debt payments to your gross monthly income. For FHA loans, the ideal DTI ratio is typically around 31% for housing expenses and 43% for total debt. This means that if your monthly gross income is $5,000, your housing expenses should not exceed $1,550, and your total monthly debt payments should be limited to $2,150.

In addition to the DTI ratio, lenders will also evaluate your employment history as part of the FHA Loan Salary Requirements. A stable job history is crucial; lenders prefer applicants who have been employed in the same field for at least two years. This demonstrates reliability and a consistent income stream, which are essential for loan approval.

Moreover, the FHA Loan Salary Requirements can vary based on your location and the specific lender you choose. Some lenders may have more lenient criteria, while others may be stricter. It’s advisable to shop around and compare different lenders to find the best fit for your financial situation. Keep in mind that your credit score will also play a significant role in determining your eligibility for an FHA loan. While FHA loans are more forgiving than conventional loans, a higher credit score can improve your chances of approval and may lead to better interest rates.

Another important aspect of the FHA Loan Salary Requirements is the down payment. FHA loans typically require a minimum down payment of 3.5% for borrowers with a credit score of 580 or higher. If your credit score is between 500 and 579, you may still qualify, but a 10% down payment will be necessary. This lower down payment requirement is one of the main advantages of FHA loans, making homeownership accessible to a broader range of people.

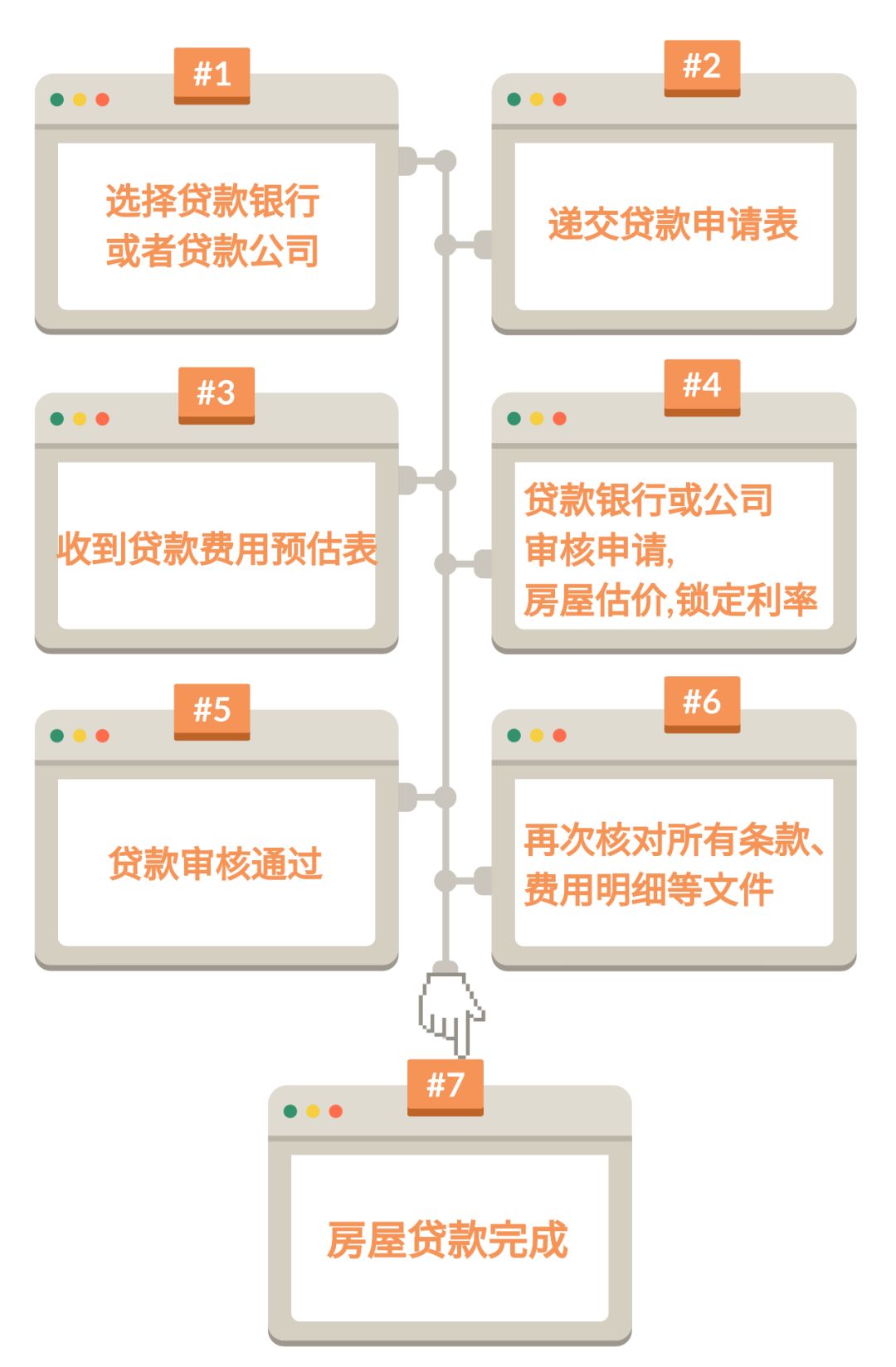

When preparing to apply for an FHA loan, it’s essential to gather all necessary documentation to verify your income and employment. This includes pay stubs, tax returns, and bank statements. Being organized and having all your documents ready can expedite the approval process and help you meet the FHA Loan Salary Requirements more effectively.

In conclusion, understanding the FHA Loan Salary Requirements is vital for anyone considering purchasing a home through an FHA loan. By familiarizing yourself with the DTI ratio, employment history expectations, and documentation needed, you can position yourself for a successful loan application. With the right preparation and knowledge, you can take the first step toward homeownership and secure the home of your dreams. Whether you are a first-time buyer or looking to refinance, knowing these requirements will empower you to make informed financial decisions and navigate the home-buying process with confidence.