Loans Summerville SC: Unlock Fast Cash with Hassle-Free Financing

If you're in need of quick cash and reside in Summerville, SC, title loans could be the perfect solution for you. Title loans Summerville SC offer a straigh……

If you're in need of quick cash and reside in Summerville, SC, title loans could be the perfect solution for you. Title loans Summerville SC offer a straightforward way to access funds using your vehicle as collateral, making it an attractive option for those facing unexpected expenses or financial emergencies.

#### What Are Title Loans?

Title loans are short-term loans that allow you to borrow money by using your vehicle's title as collateral. This means that you can get cash quickly without the need for a lengthy credit check or extensive paperwork. If you own your vehicle outright, you can leverage its value to secure a loan, making title loans a convenient option for many individuals.

#### Why Choose Title Loans in Summerville SC?

1. **Quick Approval Process**: One of the most significant advantages of title loans Summerville SC is the fast approval process. Many lenders can provide you with cash on the same day you apply. This is especially beneficial for those who need immediate funds for emergencies, medical bills, or urgent repairs.

2. **No Credit Check Required**: Unlike traditional loans that often require a good credit score, title loans focus primarily on the value of your vehicle. This means that even if you have bad credit or no credit history, you can still qualify for a loan.

3. **Retention of Vehicle**: With title loans, you can still drive your vehicle while repaying the loan. This is a significant advantage over other types of collateral loans, where you might have to surrender your asset.

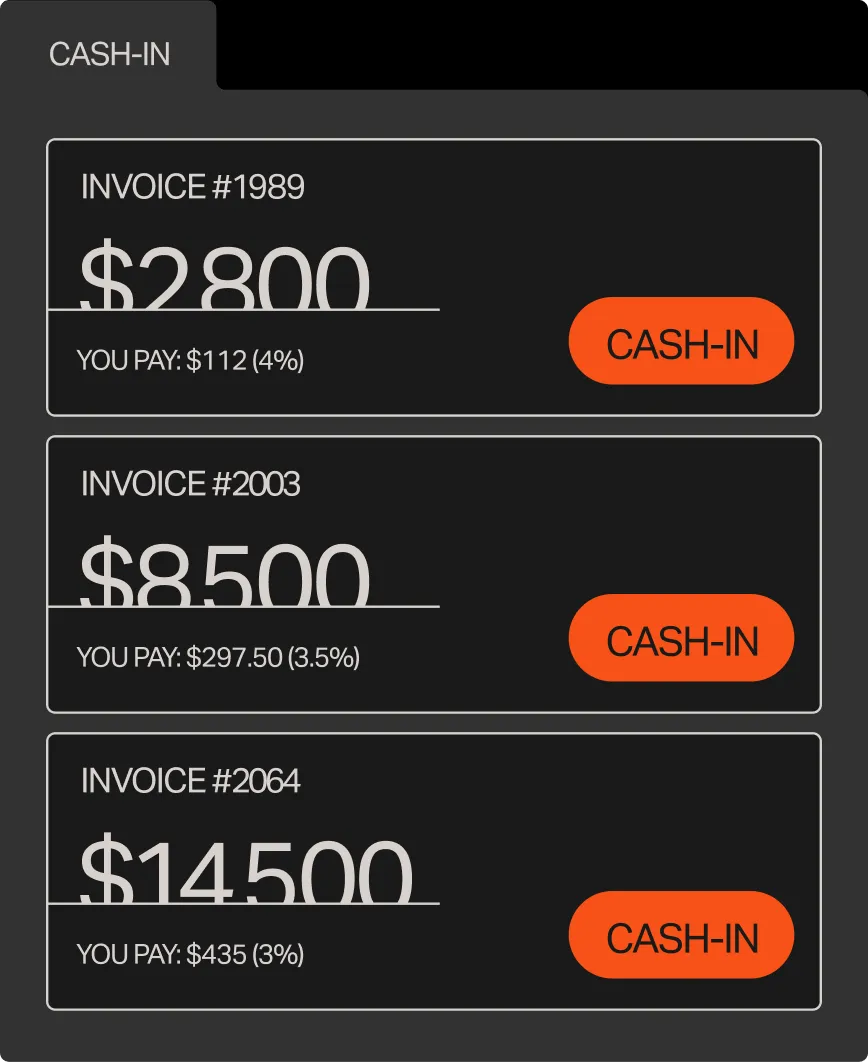

4. **Flexible Loan Amounts**: The amount you can borrow typically depends on the value of your vehicle. This means that if you own a high-value car, you can secure a larger loan amount. Title loans Summerville SC provide flexibility, allowing you to choose a loan that meets your specific financial needs.

#### How to Apply for Title Loans in Summerville SC

Applying for title loans in Summerville SC is a straightforward process. Here’s how you can get started:

1. **Gather Your Documents**: You will need to provide the title of your vehicle, proof of identity, and proof of income. Make sure that your vehicle title is clear of any liens.

2. **Find a Reputable Lender**: Research local lenders that offer title loans in Summerville SC. Look for reviews and testimonials to ensure you're working with a trustworthy company.

3. **Complete the Application**: Fill out the application form provided by the lender. This can often be done online for added convenience.

4. **Get Your Cash**: Once approved, you can receive your cash quickly, often on the same day. Be sure to understand the repayment terms and interest rates before signing any agreements.

#### Important Considerations

While title loans can be an excellent source of fast cash, it's essential to use them responsibly. Here are a few things to keep in mind:

- **Interest Rates**: Title loans can come with higher interest rates compared to traditional loans. Make sure to read the fine print and understand the total cost of the loan.

- **Repayment Terms**: Be clear about the repayment schedule. Missing payments can lead to additional fees and may put your vehicle at risk of repossession.

- **Loan Amount**: Only borrow what you can afford to repay. It's easy to get carried away with the amount you can borrow, but responsible borrowing is crucial.

In conclusion, title loans Summerville SC can be a lifeline for those in need of quick financial assistance. With a fast approval process, no credit checks, and the ability to keep your vehicle, they offer a convenient solution for many. However, it's essential to approach title loans with caution and ensure that you fully understand the terms and conditions before committing. By doing so, you can unlock the cash you need while maintaining control of your financial situation.