Unlocking Affordable Financing: Understanding the Average Interest Rate on Car Loans for Bad Credit

Guide or Summary:Introduction to Car Loans for Bad CreditWhat is Considered Bad Credit?The Average Interest Rate on Car Loans for Bad CreditFactors Influenc……

Guide or Summary:

- Introduction to Car Loans for Bad Credit

- What is Considered Bad Credit?

- The Average Interest Rate on Car Loans for Bad Credit

- Factors Influencing Interest Rates

- Tips for Securing a Better Interest Rate

Introduction to Car Loans for Bad Credit

Navigating the world of car loans can be daunting, especially for individuals with bad credit. Understanding the average interest rate on car loans for bad credit is crucial for making informed financial decisions. Bad credit can stem from various factors, including missed payments, high credit utilization, or even bankruptcy. However, it does not mean that financing a vehicle is out of reach. This article will delve into the intricacies of car loans for those with less-than-perfect credit, helping you to find the best options available.

What is Considered Bad Credit?

Before exploring the average interest rate on car loans for bad credit, it's essential to define what constitutes bad credit. Generally, a credit score below 580 is considered poor. Lenders view individuals with bad credit as high-risk borrowers, which often leads to higher interest rates and less favorable loan terms. However, understanding your credit score and the factors that influence it can empower you to take steps toward improvement.

The Average Interest Rate on Car Loans for Bad Credit

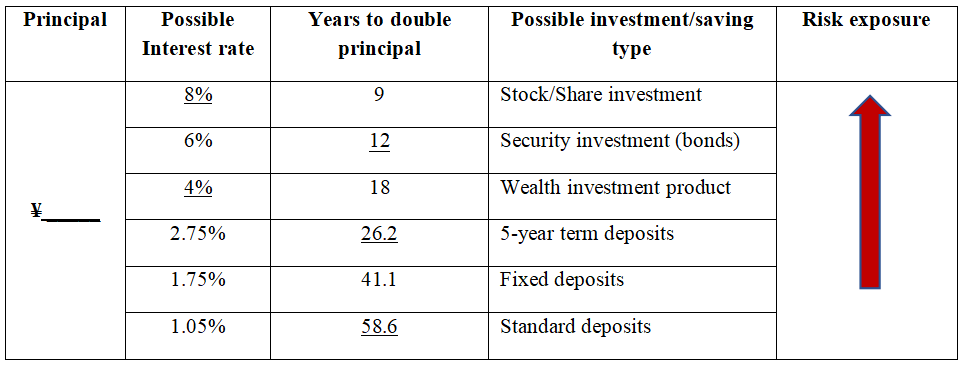

The average interest rate on car loans for bad credit typically ranges from 10% to 20%, depending on the lender and the individual’s financial situation. This rate is significantly higher than the average rate for borrowers with good credit, which can be as low as 4% to 6%. The exact rate you may qualify for will depend on several factors, including your credit score, income, the loan amount, and the loan term.

Factors Influencing Interest Rates

Several factors can influence the interest rate offered to borrowers with bad credit. These include:

1. **Credit Score**: The lower your credit score, the higher the interest rate you are likely to receive.

2. **Loan Amount**: Larger loan amounts may come with higher rates due to the increased risk for lenders.

3. **Loan Term**: Shorter loan terms may offer slightly lower rates, but monthly payments will be higher.

4. **Down Payment**: A substantial down payment can help reduce the interest rate, as it decreases the lender's risk.

5. **Lender Type**: Traditional banks often have stricter lending criteria compared to credit unions or subprime lenders.

Tips for Securing a Better Interest Rate

If you have bad credit and are looking to secure a car loan, consider the following tips to improve your chances of getting a better interest rate:

1. **Check Your Credit Report**: Review your credit report for errors and dispute any inaccuracies. This could potentially improve your score.

2. **Save for a Down Payment**: A larger down payment can reduce the loan amount and may lead to a lower interest rate.

3. **Shop Around**: Don’t settle for the first offer. Compare rates from multiple lenders, including banks, credit unions, and online lenders.

4. **Consider a Co-signer**: If possible, find a co-signer with good credit. This can help you secure a lower interest rate.

5. **Improve Your Credit Score**: Take steps to improve your credit score before applying for a loan. Pay down existing debts and make timely payments on bills.

Understanding the average interest rate on car loans for bad credit is essential for anyone looking to finance a vehicle. While bad credit can pose challenges, it is possible to find affordable financing options. By taking proactive steps to improve your creditworthiness and shopping around for the best rates, you can secure a loan that fits your budget. Remember, the goal is to find a loan that not only meets your immediate needs but also sets you on a path toward better financial health in the future.