"Maximize Your Savings with a Loan Interest Calculator Excel: A Comprehensive Guide"

#### Understanding Loan Interest Calculator ExcelA loan interest calculator Excel is an invaluable tool for anyone looking to manage their finances effectiv……

#### Understanding Loan Interest Calculator Excel

A loan interest calculator Excel is an invaluable tool for anyone looking to manage their finances effectively. This spreadsheet application allows users to calculate the interest on various types of loans, including personal loans, mortgages, and auto loans. By using this tool, borrowers can easily understand how much interest they will pay over the life of the loan, helping them make informed financial decisions.

#### Why Use a Loan Interest Calculator Excel?

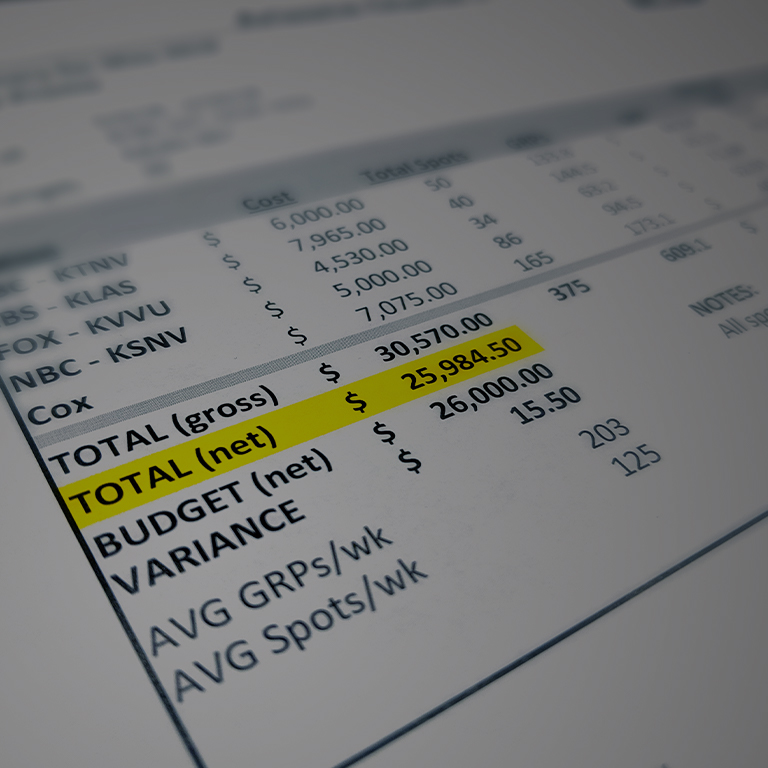

Using a loan interest calculator Excel offers several benefits. First and foremost, it provides clarity on the total cost of borrowing. Many borrowers may not fully understand how interest accumulates over time, leading to unexpected financial burdens. With this calculator, users can input their loan amount, interest rate, and loan term to see a detailed breakdown of their payments.

Additionally, the calculator can help users explore different scenarios. For instance, they can adjust the loan amount or interest rate to see how these changes affect their monthly payments and total interest paid. This feature is particularly useful for individuals contemplating multiple loan options or trying to decide between fixed and variable interest rates.

#### How to Create a Loan Interest Calculator in Excel

Creating a loan interest calculator in Excel is straightforward. Here’s a step-by-step guide:

1. **Open Excel**: Start a new spreadsheet.

2. **Input Labels**: In the first column, label the following rows: "Loan Amount," "Annual Interest Rate," "Loan Term (Years)," "Monthly Payment," and "Total Interest Paid."

3. **Enter Data**: In the adjacent cells, enter the loan amount, the annual interest rate (as a percentage), and the loan term in years.

4. **Calculate Monthly Payment**: Use the PMT function to calculate the monthly payment. The formula is:

`=PMT(interest_rate/12, loan_term*12, -loan_amount)`

Replace `interest_rate`, `loan_term`, and `loan_amount` with the corresponding cell references.

5. **Calculate Total Interest Paid**: To find the total interest paid over the life of the loan, use the formula:

`=(monthly_payment * loan_term * 12) - loan_amount`

6. **Format the Spreadsheet**: Make your calculator user-friendly by formatting cells, adding borders, and using conditional formatting to highlight important results.

#### Benefits of Using Excel for Loan Calculations

Excel provides a flexible platform for financial calculations. Users can easily modify their inputs and see real-time updates to their results. This adaptability is crucial for those who may want to experiment with different loan conditions or compare multiple loan offers side by side.

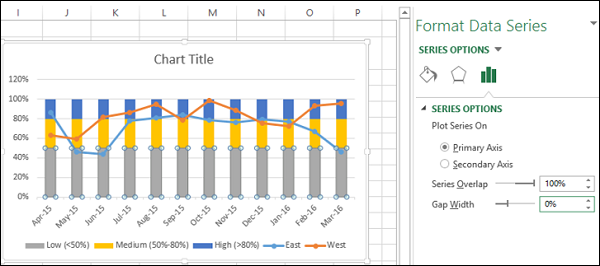

Moreover, Excel allows for the integration of additional features, such as graphs and charts, to visually represent the data. This can help users better understand their financial commitments and the impact of interest rates on their loans.

#### Conclusion

In conclusion, a loan interest calculator Excel is a powerful financial tool that can help individuals take control of their borrowing. By providing clear insights into loan costs and payment structures, it empowers users to make informed decisions about their financial futures. Whether you're considering a new loan or reevaluating your current debt, utilizing this calculator can lead to significant savings and a better understanding of your financial landscape. Start creating your loan interest calculator in Excel today and unlock the potential for smarter borrowing!