Can My Business Pay My Student Loans? Exploring the Possibilities for Entrepreneurs

Guide or Summary:Understanding the Intersection of Business and Student LoansBusiness Income and Personal ExpensesTax Deductions and Loan PaymentsBusiness L……

Guide or Summary:

- Understanding the Intersection of Business and Student Loans

- Business Income and Personal Expenses

- Tax Deductions and Loan Payments

- Business Loans and Financial Planning

- Creating a Budget that Accommodates Both Business and Personal Expenses

- Conclusion: Finding the Balance

**Translation:** Can my business pay my student loans?

---

Understanding the Intersection of Business and Student Loans

As an entrepreneur, you may find yourself juggling multiple responsibilities, including managing your business finances and repaying student loans. The question, **can my business pay my student loans**, is not just a financial query but a strategic consideration that could impact your business's growth and your personal financial health. In this article, we will explore the various ways in which your business can assist in managing or even paying off your student loans.

Business Income and Personal Expenses

First and foremost, it is crucial to understand that any income generated by your business is typically considered personal income when it comes to your financial obligations, including student loans. Therefore, while your business can generate revenue, the funds must be allocated appropriately to cover personal expenses, which include your student loan payments.

If your business is structured as a sole proprietorship, the income you earn is reported on your personal tax return. This means that you can use the profits from your business to make your student loan payments. However, it’s important to ensure that you maintain a balance between reinvesting in your business and meeting your personal financial obligations.

Tax Deductions and Loan Payments

Another avenue to explore is the potential for tax deductions associated with your business expenses. Certain business expenses can reduce your taxable income, freeing up more cash flow that can be redirected toward your student loan payments. For instance, if you operate a home-based business, you may be eligible for home office deductions. Understanding the tax implications and benefits of your business structure can help you maximize your income and allocate more funds toward your student loans.

Business Loans and Financial Planning

In some cases, entrepreneurs may consider taking out a business loan to manage their finances better. However, this approach requires careful planning and consideration. If you choose to pursue this route, it is essential to create a detailed financial plan that outlines how the loan will be utilized and how it will impact your ability to repay your student loans.

Using business funds to pay off personal debt can be risky, and it’s critical to ensure that your business remains solvent while managing personal obligations. Consulting with a financial advisor can provide insights into the best strategies for leveraging your business income to cover your student loans effectively.

Creating a Budget that Accommodates Both Business and Personal Expenses

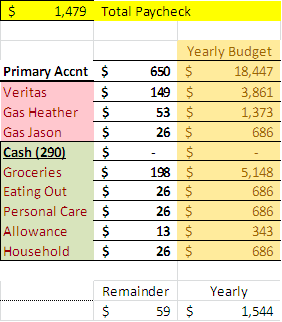

Developing a comprehensive budget that accounts for both your business and personal expenses is vital. This budget should delineate how much of your business revenue will be allocated toward your student loans each month. By carefully tracking your income and expenses, you can ensure that you’re making consistent progress toward paying off your student loans while also investing in the growth of your business.

Conclusion: Finding the Balance

In conclusion, the question, **can my business pay my student loans**, is multifaceted and requires careful consideration of your financial situation. While it is possible for your business to contribute to your student loan payments, it is essential to strike a balance between personal obligations and business growth. By understanding the intricacies of your business income, exploring tax deductions, and creating a solid budget, you can navigate the challenges of student loan repayment while ensuring your business thrives.

Ultimately, seeking professional financial advice can provide tailored strategies to help you manage both your business and personal finances effectively, allowing you to focus on your entrepreneurial journey without the burden of student loans weighing you down.