Discover the Best Options for Loans in Fort Wayne, Indiana: Your Ultimate Guide to Financing

#### Understanding Loans in Fort Wayne, IndianaWhen it comes to securing financial assistance, many residents in Fort Wayne, Indiana, find themselves explor……

#### Understanding Loans in Fort Wayne, Indiana

When it comes to securing financial assistance, many residents in Fort Wayne, Indiana, find themselves exploring various options for loans. Whether you're looking for personal loans, auto loans, or home mortgages, understanding the landscape of loans in Fort Wayne, Indiana, is crucial for making informed financial decisions. This guide will delve into the types of loans available, the application process, and tips for securing the best rates.

#### Types of Loans Available in Fort Wayne, Indiana

In Fort Wayne, you can find a variety of loan options tailored to meet different financial needs:

1. **Personal Loans**: These are unsecured loans that can be used for a variety of purposes, such as debt consolidation, medical expenses, or home improvements. Personal loans in Fort Wayne typically have fixed interest rates and flexible repayment terms.

2. **Auto Loans**: If you're looking to purchase a new or used vehicle, auto loans are a popular choice. Many local banks and credit unions offer competitive rates for auto financing, making it easier for residents to get on the road.

3. **Home Mortgages**: For those looking to buy a home in Fort Wayne, various mortgage options are available, including fixed-rate and adjustable-rate mortgages. Understanding the local real estate market can help you choose the right mortgage product for your needs.

4. **Business Loans**: Entrepreneurs in Fort Wayne can access a range of business loans to help start or expand their ventures. Local lenders often provide tailored solutions for small businesses, including lines of credit and equipment financing.

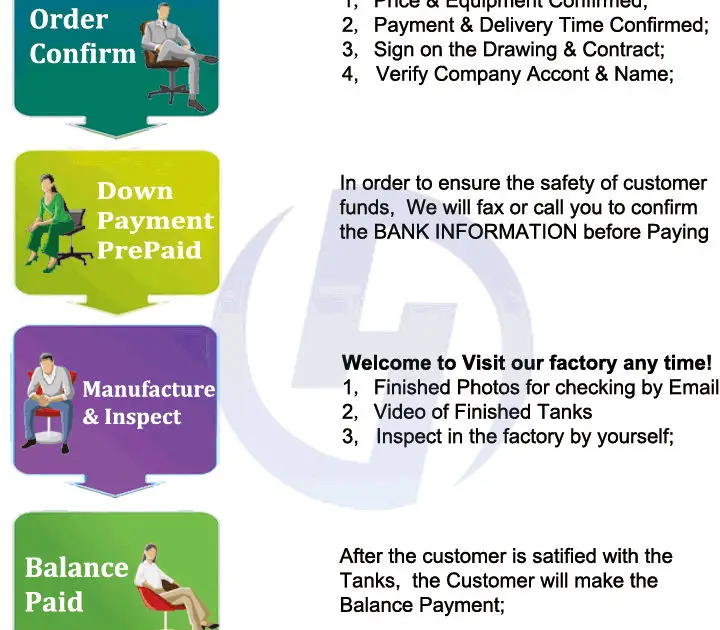

#### The Application Process for Loans in Fort Wayne, Indiana

Applying for a loan in Fort Wayne typically involves several key steps:

1. **Research Lenders**: Start by researching local banks, credit unions, and online lenders. Compare interest rates, fees, and loan terms to find the best option for your financial situation.

2. **Check Your Credit Score**: Your credit score plays a significant role in determining your eligibility for a loan and the interest rates you'll receive. Make sure to check your credit report and address any inaccuracies before applying.

3. **Gather Documentation**: Lenders will require various documents to process your application, including proof of income, employment verification, and identification. Having these documents ready can speed up the application process.

4. **Submit Your Application**: Once you've chosen a lender and gathered your documents, you can submit your loan application. Many lenders offer online applications, making it convenient to apply from home.

5. **Review Loan Offers**: After submitting your application, lenders will review your information and provide loan offers. Take your time to review the terms and conditions before making a decision.

#### Tips for Securing the Best Loans in Fort Wayne, Indiana

To maximize your chances of securing a favorable loan, consider the following tips:

1. **Improve Your Credit Score**: If your credit score is less than stellar, take steps to improve it before applying for a loan. Paying down debt and making timely payments can boost your score.

2. **Shop Around**: Don't settle for the first loan offer you receive. Shopping around allows you to compare rates and terms, ensuring you find the best deal.

3. **Consider a Co-Signer**: If you have a limited credit history or a low credit score, having a co-signer with a strong credit profile can help you secure better loan terms.

4. **Understand the Terms**: Before signing any loan agreement, make sure you fully understand the terms, including interest rates, repayment schedules, and any fees associated with the loan.

5. **Plan for Repayment**: Create a budget that includes your loan payments to ensure you can meet your financial obligations without strain.

#### Conclusion

In summary, loans in Fort Wayne, Indiana, offer a variety of options to meet the diverse financial needs of residents. By understanding the types of loans available, the application process, and tips for securing the best rates, you can navigate the lending landscape with confidence. Whether you're looking to purchase a home, buy a car, or fund a personal project, Fort Wayne has a wealth of resources to help you achieve your financial goals.