Discover the Best Equity Loan Rates at Wells Fargo: Your Comprehensive Guide to Home Equity Financing

Guide or Summary:Equity Loan Rates Wells FargoWhat is a Home Equity Loan?Understanding Equity Loan Rates at Wells FargoBenefits of Choosing Wells Fargo for……

Guide or Summary:

- Equity Loan Rates Wells Fargo

- What is a Home Equity Loan?

- Understanding Equity Loan Rates at Wells Fargo

- Benefits of Choosing Wells Fargo for Your Home Equity Loan

- How to Apply for a Home Equity Loan at Wells Fargo

Equity Loan Rates Wells Fargo

When it comes to financing your home, understanding the equity loan rates Wells Fargo offers can be a game-changer. Home equity loans are a popular option for homeowners looking to access the cash tied up in their property, and Wells Fargo, as one of the largest banks in the United States, provides competitive rates and various options tailored to meet your financial needs.

What is a Home Equity Loan?

A home equity loan allows you to borrow against the equity you've built up in your home. Essentially, it’s a second mortgage that lets you access a lump sum of money, which can be used for various purposes such as home improvements, debt consolidation, or even funding education. The amount you can borrow typically depends on your home's value and the equity you have in it.

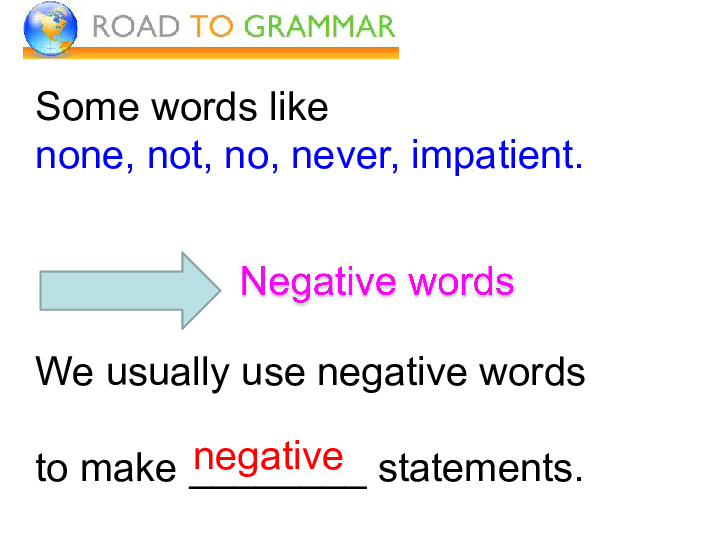

Understanding Equity Loan Rates at Wells Fargo

The equity loan rates Wells Fargo provides can vary based on several factors, including your credit score, the amount of equity you have in your home, and the current market conditions. Wells Fargo often offers fixed-rate home equity loans, which can provide peace of mind with predictable monthly payments. Additionally, they may have variable-rate options that can start lower but may fluctuate over time.

It's essential to compare these rates with other lenders to ensure you're getting the best deal possible. Wells Fargo's rates can be competitive, but they may not always be the lowest on the market. Therefore, doing your homework and shopping around is crucial.

Benefits of Choosing Wells Fargo for Your Home Equity Loan

1. **Reputation and Trust**: Wells Fargo has a long-standing history in the banking industry, which can provide a sense of security for borrowers.

2. **Variety of Options**: They offer various loan products, allowing you to choose a loan that best fits your financial situation.

3. **Online Tools and Resources**: Wells Fargo provides numerous online tools to help you calculate your potential loan amount, monthly payments, and overall costs, making it easier to understand your options.

4. **Customer Support**: With a dedicated customer service team, you can get assistance throughout the application process and beyond.

How to Apply for a Home Equity Loan at Wells Fargo

Applying for a home equity loan at Wells Fargo is a straightforward process. You can start by visiting their website to get an idea of the equity loan rates Wells Fargo offers. Here’s a step-by-step guide:

1. **Check Your Credit Score**: Before applying, check your credit score as it will significantly impact the rates you receive.

2. **Determine Your Home’s Equity**: Calculate how much equity you have in your home, which is the difference between your home’s current market value and the remaining balance on your mortgage.

3. **Gather Necessary Documentation**: Prepare documents such as income verification, tax returns, and details about your existing mortgage.

4. **Apply Online or In-Branch**: You can fill out an application online or visit a local Wells Fargo branch for personal assistance.

5. **Review Loan Options**: Once your application is processed, review the loan options presented to you, including rates and terms.

6. **Close the Loan**: After selecting the best option, you’ll go through the closing process, where you’ll sign the necessary paperwork and receive your funds.

In summary, understanding the equity loan rates Wells Fargo offers is essential for homeowners looking to leverage their property’s value. By considering the benefits, application process, and competitive rates, you can make an informed decision that aligns with your financial goals. Whether you’re looking to renovate your home or consolidate debt, a home equity loan from Wells Fargo could be a viable solution to meet your needs.