Understanding Home Equity Loan Insurance Requirements: What You Need to Know

#### Home Equity Loan Insurance RequirementsWhen considering a home equity loan, it's essential to understand the associated insurance requirements. A home……

#### Home Equity Loan Insurance Requirements

When considering a home equity loan, it's essential to understand the associated insurance requirements. A home equity loan allows homeowners to borrow against the equity they have built in their property. However, lenders often require specific insurance policies to protect their investment. This article will delve into the home equity loan insurance requirements, helping you navigate this crucial aspect of borrowing.

#### What is Home Equity?

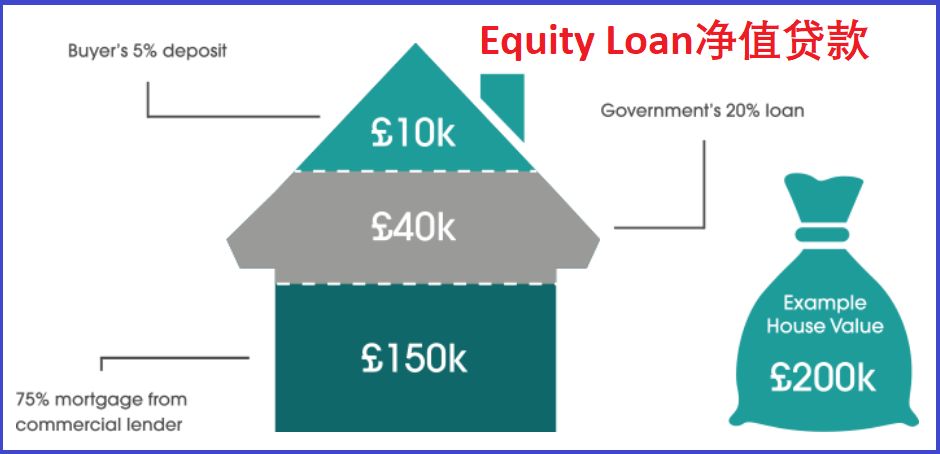

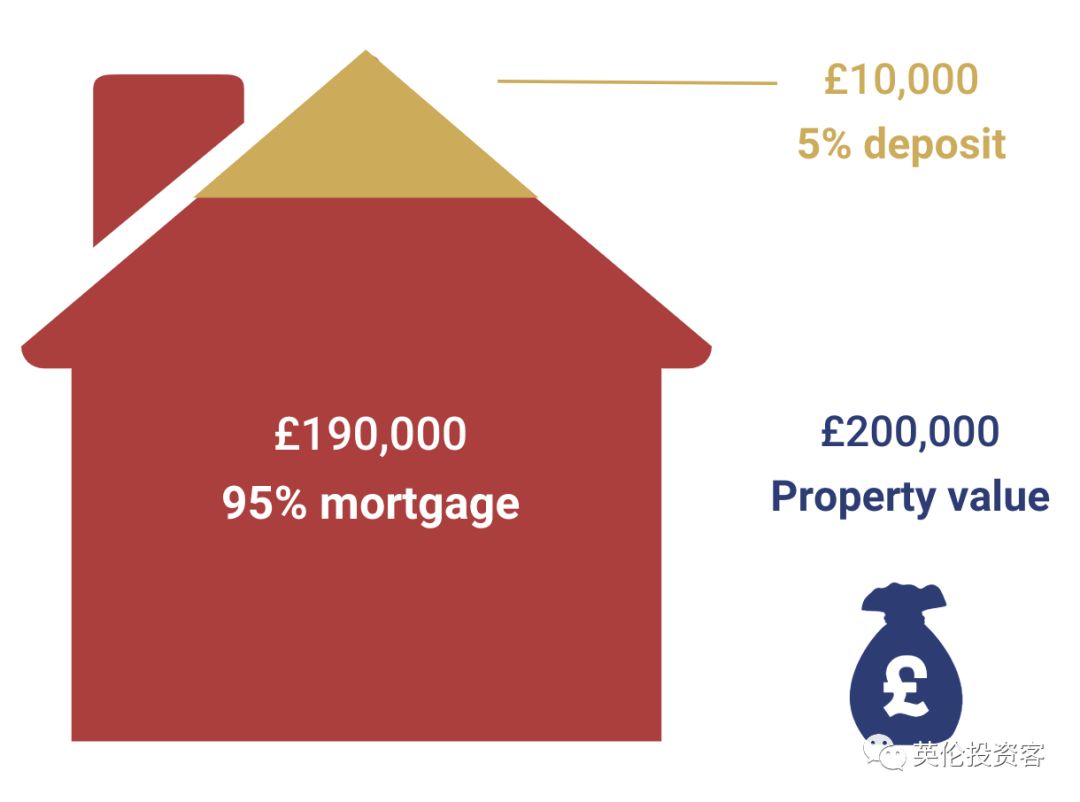

Home equity is the difference between your home's market value and the outstanding mortgage balance. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, your home equity is $100,000. Home equity loans allow you to tap into this value, providing funds for various purposes, such as home improvements, debt consolidation, or major purchases.

#### Why Are Insurance Requirements Necessary?

Lenders require insurance to mitigate risks associated with home equity loans. These requirements ensure that both the lender's investment and the borrower's property are protected. If a borrower defaults on the loan or if the property suffers damage, insurance can help cover potential losses.

#### Types of Insurance Required

1. **Homeowners Insurance**: This is the primary insurance required by lenders. Homeowners insurance protects the property against risks like fire, theft, and natural disasters. It also provides liability coverage in case someone is injured on your property. Lenders typically require borrowers to maintain a certain level of homeowners insurance throughout the life of the loan.

2. **Mortgage Insurance**: If your down payment was less than 20% when you purchased your home, you might be required to carry private mortgage insurance (PMI). This insurance protects the lender in case you default on your mortgage. While PMI is more common with primary mortgages, some lenders may require it for home equity loans as well.

3. **Flood Insurance**: If your home is located in a flood-prone area, your lender may require you to obtain flood insurance. This insurance protects against damages caused by flooding, which is not typically covered by standard homeowners insurance policies.

4. **Title Insurance**: This insurance protects against potential issues with the property title, such as liens or ownership disputes. While not always required for home equity loans, some lenders may ask for title insurance to ensure that the title is clear before approving the loan.

#### How to Meet Insurance Requirements

To meet the home equity loan insurance requirements, follow these steps:

1. **Review Your Current Policies**: Before applying for a home equity loan, review your existing homeowners insurance policy. Ensure that it meets the lender's coverage requirements.

2. **Shop for Insurance**: If you need additional coverage, such as flood insurance or PMI, shop around for the best rates. Compare quotes from different insurance providers to find a policy that fits your needs and budget.

3. **Maintain Coverage**: Once your home equity loan is approved, continue to maintain the required insurance coverage. Lenders may periodically check your insurance status, and failing to maintain coverage could result in penalties or even foreclosure.

4. **Provide Documentation**: Be prepared to provide proof of insurance to your lender. This may include a copy of your policy declarations page or an insurance binder showing that you have the necessary coverage in place.

#### Conclusion

Understanding home equity loan insurance requirements is crucial for homeowners looking to borrow against their property. By being aware of the types of insurance needed and how to meet these requirements, you can ensure a smoother borrowing process. Always consult with your lender to clarify their specific insurance requirements and make informed decisions about your home equity loan.